Page 83 - SUSTAINABILITY ISSUES & COVID-19

P. 83

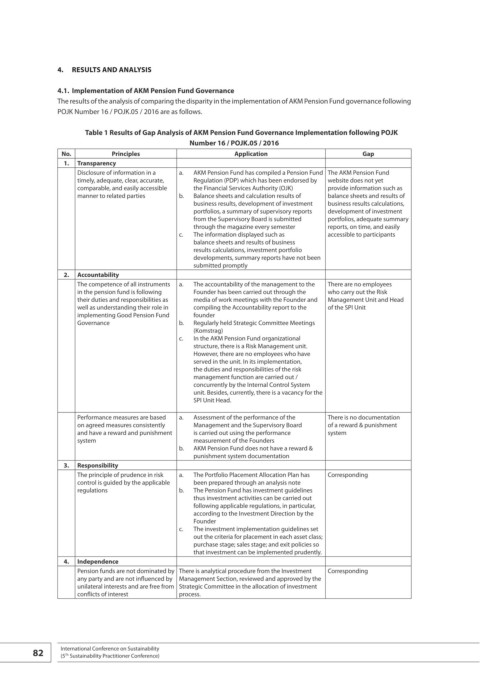

4. RESULTS AND ANALYSIS

4.1. Implementation of AKM Pension Fund Governance

The results of the analysis of comparing the disparity in the implementation of AKM Pension Fund governance following

POJK Number 16 / POJK.05 / 2016 are as follows.

Table 1 Results of Gap Analysis of AKM Pension Fund Governance Implementation following POJK

Number 16 / POJK.05 / 2016

No. Principles Application Gap

1. Transparency

Disclosure of information in a a. AKM Pension Fund has compiled a Pension Fund The AKM Pension Fund

timely, adequate, clear, accurate, Regulation (PDP) which has been endorsed by website does not yet

comparable, and easily accessible the Financial Services Authority (OJK) provide information such as

manner to related parties b. Balance sheets and calculation results of balance sheets and results of

business results, development of investment business results calculations,

portfolios, a summary of supervisory reports development of investment

from the Supervisory Board is submitted portfolios, adequate summary

through the magazine every semester reports, on time, and easily

c. The information displayed such as accessible to participants

balance sheets and results of business

results calculations, investment portfolio

developments, summary reports have not been

submitted promptly

2. Accountability

The competence of all instruments a. The accountability of the management to the There are no employees

in the pension fund is following Founder has been carried out through the who carry out the Risk

their duties and responsibilities as media of work meetings with the Founder and Management Unit and Head

well as understanding their role in compiling the Accountability report to the of the SPI Unit

implementing Good Pension Fund founder

Governance b. Regularly held Strategic Committee Meetings

(Komstrag)

c. In the AKM Pension Fund organizational

structure, there is a Risk Management unit.

However, there are no employees who have

served in the unit. In its implementation,

the duties and responsibilities of the risk

management function are carried out /

concurrently by the Internal Control System

unit. Besides, currently, there is a vacancy for the

SPI Unit Head.

Performance measures are based a. Assessment of the performance of the There is no documentation

on agreed measures consistently Management and the Supervisory Board of a reward & punishment

and have a reward and punishment is carried out using the performance system

system measurement of the Founders

b. AKM Pension Fund does not have a reward &

punishment system documentation

3. Responsibility

The principle of prudence in risk a. The Portfolio Placement Allocation Plan has Corresponding

control is guided by the applicable been prepared through an analysis note

regulations b. The Pension Fund has investment guidelines

thus investment activities can be carried out

following applicable regulations, in particular,

according to the Investment Direction by the

Founder

c. The investment implementation guidelines set

out the criteria for placement in each asset class;

purchase stage; sales stage; and exit policies so

that investment can be implemented prudently.

4. Independence

Pension funds are not dominated by There is analytical procedure from the Investment Corresponding

any party and are not influenced by Management Section, reviewed and approved by the

unilateral interests and are free from Strategic Committee in the allocation of investment

conflicts of interest process.

82 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th