Page 79 - SUSTAINABILITY ISSUES & COVID-19

P. 79

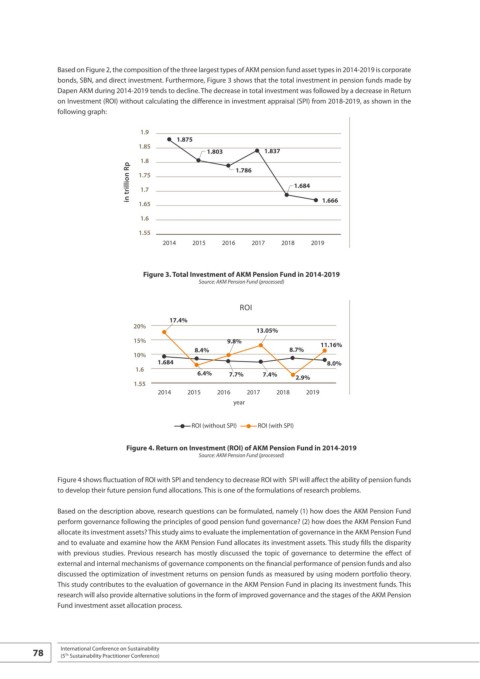

Based on Figure 2, the composition of the three largest types of AKM pension fund asset types in 2014-2019 is corporate

bonds, SBN, and direct investment. Furthermore, Figure 3 shows that the total investment in pension funds made by

Dapen AKM during 2014-2019 tends to decline. The decrease in total investment was followed by a decrease in Return

on Investment (ROI) without calculating the difference in investment appraisal (SPI) from 2018-2019, as shown in the

following graph:

1.9

1.875

1.85

1.803 1.837

1.8 1.786

in trillion Rp 1.75 1.684

1.7

1.65 1.666

1.6

1.55

2014 2015 2016 2017 2018 2019

Figure 3. Total Investment of AKM Pension Fund in 2014-2019

Source: AKM Pension Fund (processed)

ROI

17.4%

20%

13.05%

15% 9.8% 11.16%

8.4% 8.7%

10%

1.684 8.0%

1.6

6.4% 7.7% 7.4% 2.9%

1.55

2014 2015 2016 2017 2018 2019

year

ROI (without SPI) ROI (with SPI)

Figure 4. Return on Investment (ROI) of AKM Pension Fund in 2014-2019

Source: AKM Pension Fund (processed)

Figure 4 shows fluctuation of ROI with SPI and tendency to decrease ROI with SPI will affect the ability of pension funds

to develop their future pension fund allocations. This is one of the formulations of research problems.

Based on the description above, research questions can be formulated, namely (1) how does the AKM Pension Fund

perform governance following the principles of good pension fund governance? (2) how does the AKM Pension Fund

allocate its investment assets? This study aims to evaluate the implementation of governance in the AKM Pension Fund

and to evaluate and examine how the AKM Pension Fund allocates its investment assets. This study fills the disparity

with previous studies. Previous research has mostly discussed the topic of governance to determine the effect of

external and internal mechanisms of governance components on the financial performance of pension funds and also

discussed the optimization of investment returns on pension funds as measured by using modern portfolio theory.

This study contributes to the evaluation of governance in the AKM Pension Fund in placing its investment funds. This

research will also provide alternative solutions in the form of improved governance and the stages of the AKM Pension

Fund investment asset allocation process.

78 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th