Page 87 - SUSTAINABILITY ISSUES & COVID-19

P. 87

In implementing and executing its asset allocation, according to the results of its stock portfolio review, during 2019

the AKM Pension Fund has sold shares in which the profit target for the sale of its shares has been achieved as well as

switching portfolios by selling part of its bonds with a certain return to buy bonds issued by BUMN provide a higher

return. Besides, in 2019 some bonds had downgraded, which following its investment policy, the AKM Pension Fund

divested the downgraded bonds. Based on its tactical asset allocation policy, AKM Pension Fund has complied with

its securities selection policy, namely the selection of SBN securities, bonds, direct investments, as well as land and

buildings to match its estimated long-term liabilities.

In the implementation stage of its asset allocation, the AKM Pension Fund has carried out most of the stages, namely

the selection of securities as well as implementation and execution. However, in optimizing the portfolio, the AKM

Pension Fund has not taken steps to find a portfolio that can achieve the maximum return for each particular risk

level as well as the optimal asset mix that can meet the best return and risk combination that meets the investment

constraints faced. by the AKM Pension Fund.

Feedback

In monitoring the process of asset allocation, AKM Pension Fund has conducted performance evaluation by the

Investment Management Division. Based on the analysis of the investment performance monitoring documents for

each portfolio, it is known that the Investment Management Division monitors economic conditions, investors, and

market input factors every three months. Furthermore, the Pension Fund does not rebalance the composition of its

portfolio on an ongoing basis. The results of interviews with the Head of the Investment Management Division show

that the need for rebalancing is not often done at the AKM Pension Fund. This is related to the Pension Fund investment

strategy which is closely related to the concept of Asset and Liability Matching (ALM). Therefore, the rebalancing that

has been carried out by AKM Pension Fund so far is limited, meaning that it follows the condition of assets that do not

fulfill the Pension Fund’s actuarial obligations. According to Arnott and Lovell (1990) in Jones (2012), it is important

to monitor the portfolio and rebalance as needed. The thing that must be considered is when and how to do the

rebalancing because there is a tradeoff, namely the cost of trading and the cost of not trading. Thus, AKM Pension Fund

has determined when to do the rebalancing but still has to determine how to do the rebalancing.

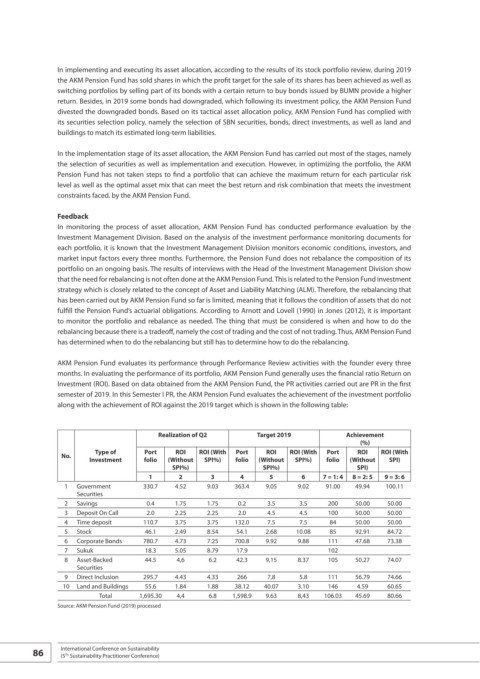

AKM Pension Fund evaluates its performance through Performance Review activities with the founder every three

months. In evaluating the performance of its portfolio, AKM Pension Fund generally uses the financial ratio Return on

Investment (ROI). Based on data obtained from the AKM Pension Fund, the PR activities carried out are PR in the first

semester of 2019. In this Semester I PR, the AKM Pension Fund evaluates the achievement of the investment portfolio

along with the achievement of ROI against the 2019 target which is shown in the following table:

Realization of Q2 Target 2019 Achievement

(%)

Type of Port ROI ROI (With Port ROI ROI (With Port ROI ROI (With

No.

Investment folio (Without SPI%) folio (Without SPI%) folio (Without SPI)

SPI%) SPI%) SPI)

1 2 3 4 5 6 7 = 1: 4 8 = 2: 5 9 = 3: 6

1 Government 330.7 4.52 9.03 363.4 9.05 9.02 91.00 49.94 100.11

Securities

2 Savings 0.4 1.75 1.75 0.2 3.5 3.5 200 50.00 50.00

3 Deposit On Call 2.0 2.25 2.25 2.0 4.5 4.5 100 50.00 50.00

4 Time deposit 110.7 3.75 3.75 132.0 7.5 7.5 84 50.00 50.00

5 Stock 46.1 2.49 8.54 54.1 2.68 10.08 85 92.91 84.72

6 Corporate Bonds 780.7 4.73 7.25 700.8 9.92 9.88 111 47.68 73.38

7 Sukuk 18.3 5.05 8.79 17.9 102

8 Asset-Backed 44.5 4,6 6.2 42.3 9,15 8.37 105 50.27 74.07

Securities

9 Direct Inclusion 295.7 4.43 4.33 266 7,8 5.8 111 56.79 74.66

10 Land and Buildings 55.6 1.84 1.88 38.12 40.07 3.10 146 4.59 60.65

Total 1,695.30 4,4 6.8 1,598.9 9.63 8,43 106.03 45.69 80.66

Source: AKM Pension Fund (2019) processed

86 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th