Page 85 - SUSTAINABILITY ISSUES & COVID-19

P. 85

Planning

At the planning stage of pension fund asset allocation, the AKM Pension Fund management has set an optimal

investment objective or target by considering investment risk, compliance with obligations, and compliance with

applicable regulations. Based on the Investment Direction document, the AKM Pension Fund must achieve an

investment return at least equal to the actuarial interest rate. The actuarial interest rate for 2019, which was determined

in the actuarial report, was 8%. Thus, the AKM Pension Fund must reach a 2019 rate of return of at least 8%.

Analysis of the 2019 Revenue and Expenditure Budget Work Plan (RKAPB) document shows that the ROI (without SPI)

and SPI targets for 2019 are 9.63% and 8.43%, respectively. In planning the allocation of assets, the AKM Pension Fund

management has limitations that are used to compile its portfolio. First, POJK Regulation Number 29 / POJK. 05/2018.

The POJK limits the maximum limit for mutual funds in the form of KIK limited participation at 10%, Medium Term

Notes (MTN) at 10%, repurchase agreement at 5%, direct investment in shares issued by legal entities established

under Indonesian law in the amount of 15%, and land and buildings by 20%. Besides, there are also limits to the POJK

Regulation Number 36 / POJK. 06/2016 which regulates the minimum SBN allocation of 30% of the total investment.

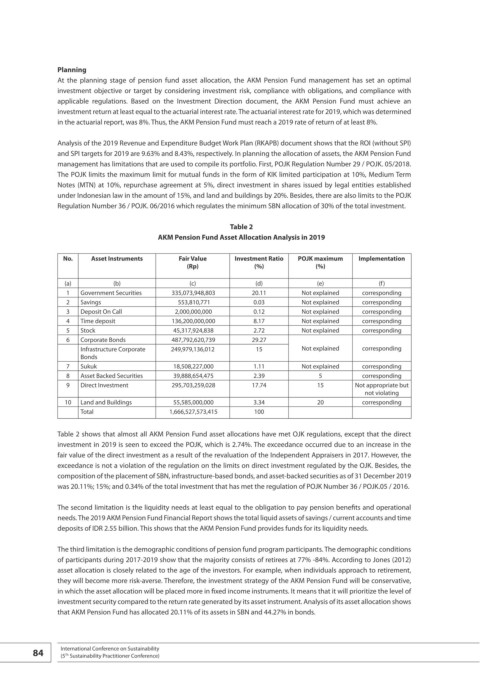

Table 2

AKM Pension Fund Asset Allocation Analysis in 2019

No. Asset Instruments Fair Value Investment Ratio POJK maximum Implementation

(Rp) (%) (%)

(a) (b) (c) (d) (e) (f)

1 Government Securities 335,073,948,803 20.11 Not explained corresponding

2 Savings 553,810,771 0.03 Not explained corresponding

3 Deposit On Call 2,000,000,000 0.12 Not explained corresponding

4 Time deposit 136,200,000,000 8.17 Not explained corresponding

5 Stock 45,317,924,838 2.72 Not explained corresponding

6 Corporate Bonds 487,792,620,739 29.27

Infrastructure Corporate 249,979,136,012 15 Not explained corresponding

Bonds

7 Sukuk 18,508,227,000 1.11 Not explained corresponding

8 Asset Backed Securities 39,888,654,475 2.39 5 corresponding

9 Direct Investment 295,703,259,028 17.74 15 Not appropriate but

not violating

10 Land and Buildings 55,585,000,000 3.34 20 corresponding

Total 1,666,527,573,415 100

Table 2 shows that almost all AKM Pension Fund asset allocations have met OJK regulations, except that the direct

investment in 2019 is seen to exceed the POJK, which is 2.74%. The exceedance occurred due to an increase in the

fair value of the direct investment as a result of the revaluation of the Independent Appraisers in 2017. However, the

exceedance is not a violation of the regulation on the limits on direct investment regulated by the OJK. Besides, the

composition of the placement of SBN, infrastructure-based bonds, and asset-backed securities as of 31 December 2019

was 20.11%; 15%; and 0.34% of the total investment that has met the regulation of POJK Number 36 / POJK.05 / 2016.

The second limitation is the liquidity needs at least equal to the obligation to pay pension benefits and operational

needs. The 2019 AKM Pension Fund Financial Report shows the total liquid assets of savings / current accounts and time

deposits of IDR 2.55 billion. This shows that the AKM Pension Fund provides funds for its liquidity needs.

The third limitation is the demographic conditions of pension fund program participants. The demographic conditions

of participants during 2017-2019 show that the majority consists of retirees at 77% -84%. According to Jones (2012)

asset allocation is closely related to the age of the investors. For example, when individuals approach to retirement,

they will become more risk-averse. Therefore, the investment strategy of the AKM Pension Fund will be conservative,

in which the asset allocation will be placed more in fixed income instruments. It means that it will prioritize the level of

investment security compared to the return rate generated by its asset instrument. Analysis of its asset allocation shows

that AKM Pension Fund has allocated 20.11% of its assets in SBN and 44.27% in bonds.

84 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th