Page 72 - SUSTAINABILITY ISSUES & COVID-19

P. 72

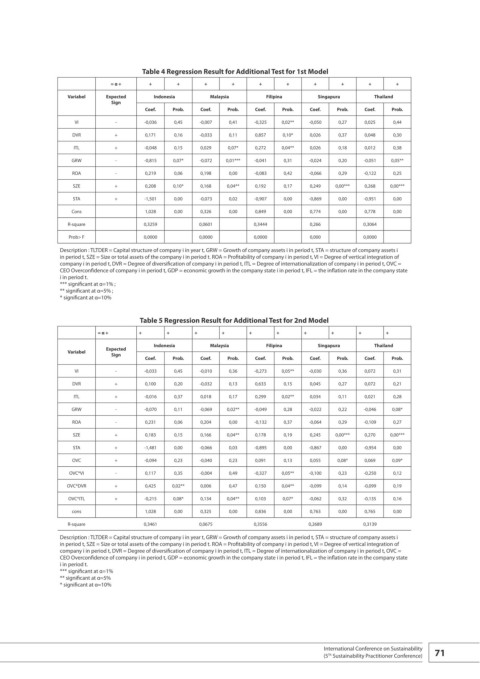

Table 4 Regression Result for Additional Test for 1st Model

= α + + + + + + + + + + +

Variabel Expected Indonesia Malaysia Filipina Singapura Thailand

Sign

Coef. Prob. Coef. Prob. Coef. Prob. Coef. Prob. Coef. Prob.

VI - -0,036 0,45 -0,007 0,41 -0,325 0,02** -0,050 0,27 0,025 0,44

DVR + 0,171 0,16 -0,033 0,11 0,857 0,10* 0,026 0,37 0,048 0,30

ITL + -0,048 0,15 0,029 0,07* 0,272 0,04** 0,026 0,18 0,012 0,38

GRW - -0,815 0,07* -0,072 0,01*** -0,041 0,31 -0,024 0,20 -0,051 0,05**

ROA - 0,219 0,06 0,198 0,00 -0,083 0,42 -0,066 0,29 -0,122 0,25

SZE + 0,208 0,10* 0,168 0,04** 0,192 0,17 0,249 0,00*** 0,268 0,00***

STA + -1,501 0,00 -0,073 0,02 -0,907 0,00 -0,869 0,00 -0,951 0,00

Cons 1,028 0,00 0,326 0,00 0,849 0,00 0,774 0,00 0,778 0,00

R-square 0,3259 0,0601 0,3444 0,266 0,3064

Prob> F 0,0000 0,0000 0,0000 0,000 0,0000

Description : TLTDER = Capital structure of company i in year t, GRW = Growth of company assets i in period t, STA = structure of company assets i

in period t, SZE = Size or total assets of the company i in period t. ROA = Profitability of company i in period t, VI = Degree of vertical integration of

company i in period t, DVR = Degree of diversification of company i in period t, ITL = Degree of internationalization of company i in period t, OVC =

CEO Overconfidence of company i in period t, GDP = economic growth in the company state i in period t, IFL = the inflation rate in the company state

i in period t.

*** significant at α=1% ;

** significant at α=5% ;

* significant at α=10%

Table 5 Regression Result for Additional Test for 2nd Model

= α + + + + + + + + + + +

Indonesia Malaysia Filipina Singapura Thailand

Variabel Expected

Sign

Coef. Prob. Coef. Prob. Coef. Prob. Coef. Prob. Coef. Prob.

VI - -0,033 0,45 -0,010 0,36 -0,273 0,05** -0,030 0,36 0,072 0,31

DVR + 0,100 0,20 -0,032 0,13 0,633 0,15 0,045 0,27 0,072 0,21

ITL + -0,016 0,37 0,018 0,17 0,299 0,02** 0,034 0,11 0,021 0,28

GRW - -0,070 0,11 -0,069 0,02** -0,049 0,28 -0,022 0,22 -0,046 0,08*

ROA - 0,231 0,06 0,204 0,00 -0,132 0,37 -0,064 0,29 -0,109 0,27

SZE + 0,183 0,15 0,166 0,04** 0,178 0,19 0,245 0,00*** 0,270 0,00***

STA + -1,481 0,00 -0,066 0,03 -0,895 0,00 -0,867 0,00 -0,954 0,00

OVC + -0,094 0,23 -0,040 0,23 0,091 0,13 0,055 0,08* 0,069 0,09*

OVC*VI - 0,117 0,35 -0,004 0,49 -0,327 0,05** -0,100 0,23 -0,250 0,12

OVC*DVR + 0,425 0,02** 0,006 0,47 0,150 0,04** -0,099 0,14 -0,099 0,19

OVC*ITL + -0,215 0,08* 0,134 0,04** 0,103 0,07* -0,062 0,32 -0,135 0,16

cons 1,028 0,00 0,325 0,00 0,836 0,00 0,763 0,00 0,765 0,00

R-square 0,3461 0,0675 0,3556 0,2689 0,3139

Description : TLTDER = Capital structure of company i in year t, GRW = Growth of company assets i in period t, STA = structure of company assets i

in period t, SZE = Size or total assets of the company i in period t. ROA = Profitability of company i in period t, VI = Degree of vertical integration of

company i in period t, DVR = Degree of diversification of company i in period t, ITL = Degree of internationalization of company i in period t, OVC =

CEO Overconfidence of company i in period t, GDP = economic growth in the company state i in period t, IFL = the inflation rate in the company state

i in period t.

*** significant at α=1%

** significant at α=5%

* significant at α=10%

International Conference on Sustainability 71

(5 Sustainability Practitioner Conference)

Th