Page 71 - SUSTAINABILITY ISSUES & COVID-19

P. 71

Table 2 shows the results of the Pearson correlation test to assess the correlation between the variables used in the

research model. Based on the Pearson correlation test in the ASEAN sample, 5 shows that most independent variables

have a significant correlation to the level of corporate leverage, except for internationalization. Overconfidence has

a significant negative correlation with the vertical integration strategy but has a significant positive correlation with

the diversification strategy. Overconfidence does not have a significant correlation with internationalization strategies.

4.2 Descriptive Sample and Pearson Correlation

The results of the regression method test using the Chow Test, the Hausman Test show that the fixed effect model is

the best model both for the first and second models in ASEAN 5 regression samples. The same results for the additional

test in every country. Based on the classical assumption test, each variable in both first and second models is free from

multicollinearity but is subject to autocorrelation and heteroskedasticity. Hence this study uses the robust fixed effect

regression model to overcome autocorrelation and heteroskedasticity. These results apply to all tests for both ASEAN

5 samples and partially in every country.

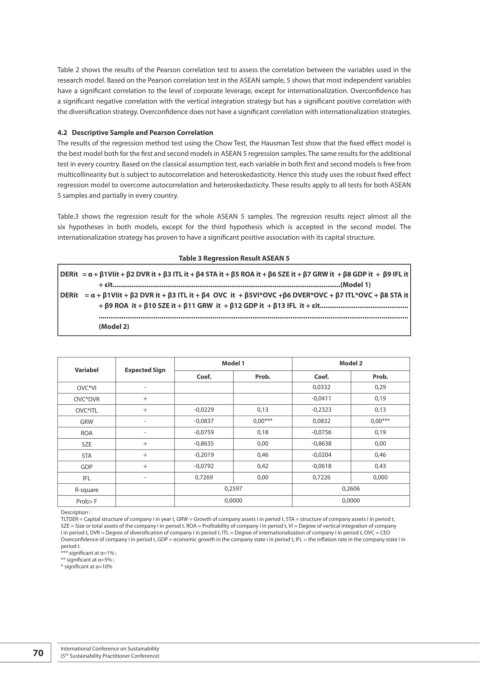

Table.3 shows the regression result for the whole ASEAN 5 samples. The regression results reject almost all the

six hypotheses in both models, except for the third hypothesis which is accepted in the second model. The

internationalization strategy has proven to have a significant positive association with its capital structure.

Table 3 Regression Result ASEAN 5

DERit = α + β1VIit + β2 DVR it + β3 ITL it + β4 STA it + β5 ROA it + β6 SZE it + β7 GRW it + β8 GDP it + β9 IFL it

+ εit.........................................................................................................................(Model 1)

DERit = α + β1VIit + β2 DVR it + β3 ITL it + β4 OVC it + β5VI*OVC +β6 DVER*OVC + β7 ITL*OVC + β8 STA it

+ β9 ROA it + β10 SZE it + β11 GRW it + β12 GDP it + β13 IFL it + εit...............................................

...................................................................................................................................................................

(Model 2)

odel 2)

Model 1 Model 2

Variabel Expected Sign

Coef. Prob. Coef. Prob.

OVC*VI - 0,0332 0,29

OVC*DVR + -0,0411 0,19

OVC*ITL + -0,0229 0,13 -0,2323 0,13

GRW - -0,0837 0,00*** 0,0832 0,00***

ROA - -0,0759 0,18 -0,0756 0,19

SZE + -0,8635 0,00 -0,8638 0,00

STA + -0,2019 0,46 -0,0204 0,46

GDP + -0,0792 0,42 -0,0618 0,43

IFL - 0,7269 0,00 0,7226 0,000

R-square 0,2597 0,2606

Prob> F 0,0000 0,0000

Description :

TLTDER = Capital structure of company i in year t, GRW = Growth of company assets i in period t, STA = structure of company assets i in period t,

SZE = Size or total assets of the company i in period t. ROA = Profitability of company i in period t, VI = Degree of vertical integration of company

i in period t, DVR = Degree of diversification of company i in period t, ITL = Degree of internationalization of company i in period t, OVC = CEO

Overconfidence of company i in period t, GDP = economic growth in the company state i in period t, IFL = the inflation rate in the company state i in

period t.

*** significant at α=1% ;

** significant at α=5% ;

* significant at α=10%

70 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th