Page 70 - SUSTAINABILITY ISSUES & COVID-19

P. 70

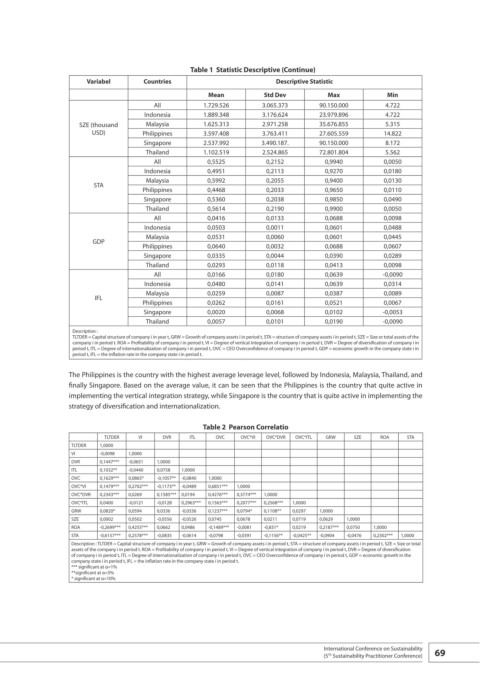

Table 1 Statistic Descriptive (Continue)

Variabel Countries Descriptive Statistic

Mean Std Dev Max Min

All 1.729.526 3.065.373 90.150.000 4.722

Indonesia 1.889.348 3.176.624 23.979.896 4.722

SZE (thousand Malaysia 1.625.313 2.971.258 35.676.855 5.315

USD) Philippines 3.597.408 3.763.411 27.605.559 14.822

Singapore 2.537.992 3.490.187. 90.150.000 8.172

Thailand 1.102.519 2.524.865 72.801.804 5.562

All 0,5525 0,2152 0,9940 0,0050

Indonesia 0,4951 0,2113 0,9270 0,0180

Malaysia 0,5992 0,2055 0,9400 0,0130

STA

Philippines 0,4468 0,2033 0,9650 0,0110

Singapore 0,5360 0,2038 0,9850 0,0490

Thailand 0,5614 0,2190 0,9900 0,0050

All 0,0416 0,0133 0,0688 0,0098

Indonesia 0,0503 0,0011 0,0601 0,0488

Malaysia 0,0531 0,0060 0,0601 0,0445

GDP

Philippines 0,0640 0,0032 0,0688 0,0607

Singapore 0,0335 0,0044 0,0390 0,0289

Thailand 0,0293 0,0118 0,0413 0,0098

All 0,0166 0,0180 0,0639 -0,0090

Indonesia 0,0480 0,0141 0,0639 0,0314

Malaysia 0,0259 0,0087 0,0387 0,0089

IFL

Philippines 0,0262 0,0161 0,0521 0,0067

Singapore 0,0020 0,0068 0,0102 -0,0053

Thailand 0,0057 0,0101 0,0190 -0,0090

Description :

TLTDER = Capital structure of company i in year t, GRW = Growth of company assets i in period t, STA = structure of company assets i in period t, SZE = Size or total assets of the

company i in period t. ROA = Profitability of company i in period t, VI = Degree of vertical integration of company i in period t, DVR = Degree of diversification of company i in

period t, ITL = Degree of internationalization of company i in period t, OVC = CEO Overconfidence of company i in period t, GDP = economic growth in the company state i in

period t, IFL = the inflation rate in the company state i in period t.

The Philippines is the country with the highest average leverage level, followed by Indonesia, Malaysia, Thailand, and

finally Singapore. Based on the average value, it can be seen that the Philippines is the country that quite active in

implementing the vertical integration strategy, while Singapore is the country that is quite active in implementing the

strategy of diversification and internationalization.

Table 2 Pearson Correlatio

TLTDER VI DVR ITL OVC OVC*VI OVC*DVR OVC*ITL GRW SZE ROA STA

TLTDER 1,0000

VI -0,0098 1,0000

DVR 0,1447*** -0,0651 1,0000

ITL 0,1032** -0,0440 0,0758 1,0000

OVC 0,1629*** 0,0865* -0,1057** -0,0840 1,0000

OVC*VI 0,1479*** 0,2702*** -0,1173** -0,0489 0,6851*** 1,0000

OVC*DVR 0,2343*** 0,0269 0,1585*** 0,0194 0,4276*** 0,3774*** 1,0000

OVC*ITL 0,0400 -0,0121 -0,0128 0,2963*** 0,1563*** 0,2077*** 0,2568*** 1,0000

GRW 0,0820* 0,0594 0,0336 -0,0336 0,1237*** 0,0794* 0,1108** 0,0297 1,0000

SZE 0,0002 0,0502 -0,0556 -0,0526 0,0745 0,0678 0,0211 0,0719 0,0629 1,0000

ROA -0,2699*** 0,4255*** 0,0662 0,0486 -0,1489*** -0,0081 -0,831* 0,0219 0,2187*** 0,0750 1,0000

STA -0,6157*** 0,2578*** -0,0835 -0,0614 -0,0798 -0,0391 -0,1156** -0,0425** -0,0904 -0,0476 0,2302*** 1,0000

Description : TLTDER = Capital structure of company i in year t, GRW = Growth of company assets i in period t, STA = structure of company assets i in period t, SZE = Size or total

assets of the company i in period t. ROA = Profitability of company i in period t, VI = Degree of vertical integration of company i in period t, DVR = Degree of diversification

of company i in period t, ITL = Degree of internationalization of company i in period t, OVC = CEO Overconfidence of company i in period t, GDP = economic growth in the

company state i in period t, IFL = the inflation rate in the company state i in period t.

*** significant at α=1%

**significant at α=5%

* significant at α=10%

International Conference on Sustainability 69

(5 Sustainability Practitioner Conference)

Th