Page 67 - SUSTAINABILITY ISSUES & COVID-19

P. 67

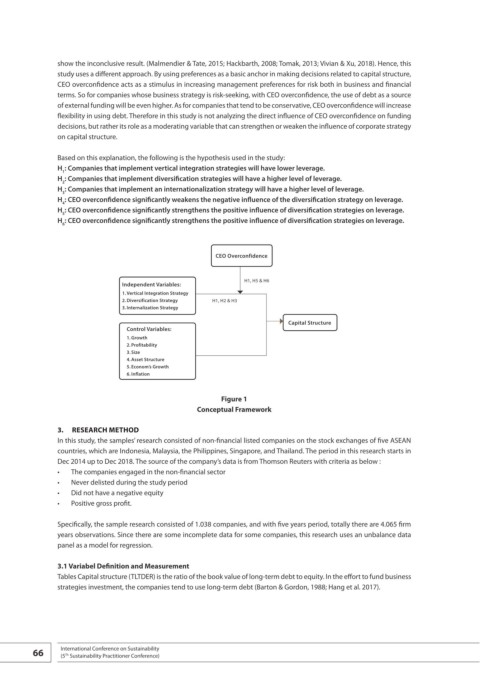

show the inconclusive result. (Malmendier & Tate, 2015; Hackbarth, 2008; Tomak, 2013; Vivian & Xu, 2018). Hence, this

study uses a different approach. By using preferences as a basic anchor in making decisions related to capital structure,

CEO overconfidence acts as a stimulus in increasing management preferences for risk both in business and financial

terms. So for companies whose business strategy is risk-seeking, with CEO overconfidence, the use of debt as a source

of external funding will be even higher. As for companies that tend to be conservative, CEO overconfidence will increase

flexibility in using debt. Therefore in this study is not analyzing the direct influence of CEO overconfidence on funding

decisions, but rather its role as a moderating variable that can strengthen or weaken the influence of corporate strategy

on capital structure.

Based on this explanation, the following is the hypothesis used in the study:

H : Companies that implement vertical integration strategies will have lower leverage.

1

H : Companies that implement diversification strategies will have a higher level of leverage.

2

H : Companies that implement an internationalization strategy will have a higher level of leverage.

3

H : CEO overconfidence significantly weakens the negative influence of the diversification strategy on leverage.

4

H : CEO overconfidence significantly strengthens the positive influence of diversification strategies on leverage.

5

H : CEO overconfidence significantly strengthens the positive influence of diversification strategies on leverage.

6

CEO Overconfidence

H1, H5 & H6

Independent Variables:

1. Vertical Integration Strategy

2. Diversification Strategy H1, H2 & H3

3. Internalization Strategy

Capital Structure

Control Variables:

1. Growth

2. Profitability

3. Size

4. Asset Structure

5. Econom’s Growth

6. Inflation

Figure 1

Conceptual Framework

3. RESEARCH METHOD

In this study, the samples’ research consisted of non-financial listed companies on the stock exchanges of five ASEAN

countries, which are Indonesia, Malaysia, the Philippines, Singapore, and Thailand. The period in this research starts in

Dec 2014 up to Dec 2018. The source of the company’s data is from Thomson Reuters with criteria as below :

• The companies engaged in the non-financial sector

• Never delisted during the study period

• Did not have a negative equity

• Positive gross profit.

Specifically, the sample research consisted of 1.038 companies, and with five years period, totally there are 4.065 firm

years observations. Since there are some incomplete data for some companies, this research uses an unbalance data

panel as a model for regression.

3.1 Variabel Definition and Measurement

Tables Capital structure (TLTDER) is the ratio of the book value of long-term debt to equity. In the effort to fund business

strategies investment, the companies tend to use long-term debt (Barton & Gordon, 1988; Hang et al. 2017).

66 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th