Page 58 - SUSTAINABILITY ISSUES & COVID-19

P. 58

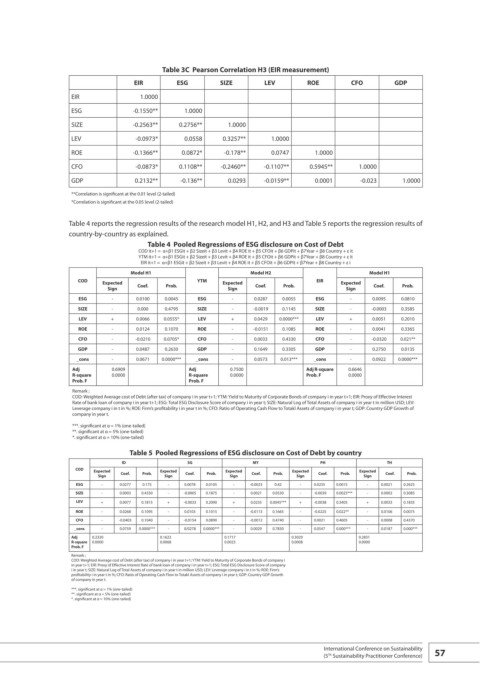

Table 3C Pearson Correlation H3 (EIR measurement)

EIR ESG SIZE LEV ROE CFO GDP

EIR 1.0000

ESG -0.1550** 1.0000

SIZE -0.2563** 0.2756** 1.0000

LEV -0.0973* 0.0558 0.3257** 1.0000

ROE -0.1366** 0.0872* -0.178** 0.0747 1.0000

CFO -0.0873* 0.1108** -0.2460** -0.1107** 0.5945** 1.0000

GDP 0.2132** -0.136** 0.0293 -0.0159** 0.0001 -0.023 1.0000

**Correlation is significant at the 0.01 level (2-tailed)

*Correlation is significant at the 0.05 level (2-tailed)

Table 4 reports the regression results of the research model H1, H2, and H3 and Table 5 reports the regression results of

country-by-country as explained.

Table 4 Pooled Regressions of ESG disclosure on Cost of Debt

COD it+1 = α+β1 ESGit + β2 Sizeit + β3 Levit + β4 ROE it + β5 CFOit + β6 GDPit + β7Year + β8 Country + ε it

YTM it+1 = α+β1 ESGit + β2 Sizeit + β3 Levit + β4 ROE it + β5 CFOit + β6 GDPit + β7Year + β8 Country + ε it

EIR it+1 = α+β1 ESGit + β2 Sizeit + β3 Levit + β4 ROE it + β5 CFOit + β6 GDPit + β7Year + β8 Country + ε i

Model H1 Model H2 Model H1

COD Expected YTM Expected EIR Expected

Sign Coef. Prob. Sign Coef. Prob. Sign Coef. Prob.

ESG - 0.0100 0.0045 ESG - 0.0287 0.0055 ESG - 0.0095 0.0810

SIZE - 0.000 0.4795 SIZE - -0.0019 0.1145 SIZE - -0.0003 0.3585

LEV + 0.0066 0.0555* LEV + 0.0429 0.0000*** LEV + 0.0051 0.2010

ROE - 0.0124 0.1070 ROE - -0.0151 0.1085 ROE - 0.0041 0.3365

CFO - -0.0210 0.0705* CFO - 0.0033 0.4330 CFO - -0.0320 0.021**

GDP - 0.0487 0.2630 GDP - 0.1649 0.3305 GDP - 0.2750 0.0135

_cons - 0.0671 0.0000*** _cons - 0.0573 0.013*** _cons - 0.0922 0.0000***

Adj 0.6909 Adj 0.7500 Adj R-square 0.6646

R-square 0.0000 R-square 0.0000 Prob. F 0.0000

Prob. F Prob. F

Remark ;

COD: Weighted Average cost of Debt (after tax) of company i in year t+1; YTM: Yield to Maturity of Corporate Bonds of company i in year t+1; EIR: Proxy of Effective Interest

Rate of bank loan of company i in year t+1; ESG: Total ESG Disclosure Score of company i in year t; SIZE: Natural Log of Total Assets of company i in year t in million USD; LEV:

Leverage company i in t in %; ROE: Firm’s profitability i in year t in %; CFO: Ratio of Operating Cash Flow to Totakl Assets of company i in year t; GDP: Country GDP Growth of

company in year t.

***. significant at α = 1% (one-tailed)

**. significant at α = 5% (one-tailed)

*. significant at α = 10% (one-tailed)

Table 5 Pooled Regressions of ESG disclosure on Cost of Debt by country

ID SG MY PH TH

COD Expected Expected Expected Expected Expected

Sign Coef. Prob. Sign Coef. Prob. Sign Coef. Prob. Sign Coef. Prob. Sign Coef. Prob.

ESG - 0.0277 0.175 - 0.0078 0.0105 - -0.0023 0.42 - 0.0235 0.0015 - 0.0021 0.2625

SIZE - 0.0003 0.4330 - -0.0005 0.1875 - 0.0021 0.0530 - -0.0039 0.0025*** - 0.0002 0.3085

LEV + 0.0077 0.1815 + -0.0033 0.2090 + 0.0235 0.0045*** + -0.0038 0.3405 + 0.0033 0.1835

ROE - 0.0268 0.1095 - 0.0103 0.1015 - -0.0113 0.1665 - -0.0225 0.022** - 0.0106 0.0075

CFO - -0.0403 0.1040 - -0.0154 0.0890 - -0.0012 0.4740 - 0.0021 0.4605 - 0.0008 0.4370

_cons - 0.0759 0.0000*** - 0/0278 0.0000*** - 0.0029 0.7830 - 0.0547 0.000*** - 0.0187 0.000***

Adj 0.2320 0.1622 0.1717 0.3029 0.2831

R-square 0.0000 0.0068 0.0023 0.0008 0.0000

Prob. F

Remark ;

COD: Weighted Average cost of Debt (after tax) of company i in year t+1; YTM: Yield to Maturity of Corporate Bonds of company i

in year t+1; EIR: Proxy of Effective Interest Rate of bank loan of company i in year t+1; ESG: Total ESG Disclosure Score of company

i in year t; SIZE: Natural Log of Total Assets of company i in year t in million USD; LEV: Leverage company i in t in %; ROE: Firm’s

profitability i in year t in %; CFO: Ratio of Operating Cash Flow to Totakl Assets of company i in year t; GDP: Country GDP Growth

of company in year t.

***. significant at α = 1% (one-tailed)

**. significant at α = 5% (one-tailed)

*. significant at α = 10% (one-tailed)

International Conference on Sustainability 57

(5 Sustainability Practitioner Conference)

Th