Page 55 - SUSTAINABILITY ISSUES & COVID-19

P. 55

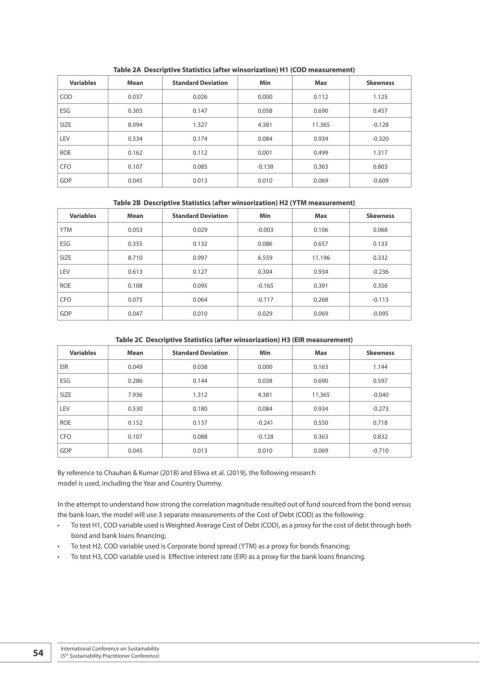

Table 2A Descriptive Statistics (after winsorization) H1 (COD measurement)

Variables Mean Standard Deviation Min Max Skewness

COD 0.037 0.026 0.000 0.112 1.125

ESG 0.303 0.147 0.058 0.690 0.457

SIZE 8.094 1.327 4.381 11.365 -0.128

LEV 0.534 0.174 0.084 0.934 -0.320

ROE 0.162 0.112 0.001 0.499 1.317

CFO 0.107 0.085 -0.138 0.363 0.803

GDP 0.045 0.013 0.010 0.069 -0.609

Table 2B Descriptive Statistics (after winsorization) H2 (YTM measurement)

Variables Mean Standard Deviation Min Max Skewness

YTM 0.053 0.029 -0.003 0.106 0.068

ESG 0.355 0.132 0.086 0.657 0.133

SIZE 8.710 0.997 6.559 11.196 0.332

LEV 0.613 0.127 0.304 0.934 -0.236

ROE 0.108 0.095 -0.165 0.391 0.356

CFO 0.075 0.064 -0.117 0.268 -0.113

GDP 0.047 0.010 0.029 0.069 -0.095

Table 2C Descriptive Statistics (after winsorization) H3 (EIR measurement)

Variables Mean Standard Deviation Min Max Skewness

EIR 0.049 0.038 0.000 0.163 1.144

ESG 0.286 0.144 0.038 0.690 0.597

SIZE 7.936 1.312 4.381 11.365 -0.040

LEV 0.530 0.180 0.084 0.934 -0.273

ROE 0.152 0.137 -0.241 0.550 0.718

CFO 0.107 0.088 -0.128 0.363 0.832

GDP 0.045 0.013 0.010 0.069 -0.710

By reference to Chauhan & Kumar (2018) and Eliwa et al. (2019), the following research

model is used, including the Year and Country Dummy.

In the attempt to understand how strong the correlation magnitude resulted out of fund sourced from the bond versus

the bank loan, the model will use 3 separate measurements of the Cost of Debt (COD) as the following:

• To test H1, COD variable used is Weighted Average Cost of Debt (COD), as a proxy for the cost of debt through both

bond and bank loans financing;

• To test H2, COD variable used is Corporate bond spread (YTM) as a proxy for bonds financing;

• To test H3, COD variable used is Effective interest rate (EIR) as a proxy for the bank loans financing.

54 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th