Page 53 - SUSTAINABILITY ISSUES & COVID-19

P. 53

relative correlation magnitude. In a credit analysis/assessment for a corporate loan, the bank naturally would be heavily

relying on the information obtained through the credit analyst and the Relationship Manager, such as the borrower

historical repayment, profitability, the assets pledged for collateral or other business considerations. Not merely the

public information that the bank uses to justify the credit risk, as in the case of the public bond, but also other bank’s

internal tools/methods existence. Whereas in contrary, the bondholder would act similarly as the investor in the market

by accessing the company’s information on public domain and analyze to determine the firm’s credit risk (perception)

based on other publicly available information. Due to these differences, it is expected that the correlation between ESG

and the cost of debt from bank borrowing has less magnitude than the bond. Based on the reasoning, the hypotheses

H2 and H3 are developed:

H .The firm ESG disclosure index is negatively associated with the bonds YTM (Yield To Maturity).

2

H .The firm ESG disclosure index is negatively associated with the bank loans EIR (Effective Interest Rate).

3

3. RESEARCH METHOD

1.1 Data and Samples

In the attempt to obtain some insight/evidence within ASEAN to understand the effects of ESG (disclosure) to the cost

of debt from both debt securities (bond) and the bank loan, the quantitative research involves measurements overtime

for the number of firms selected. Total panel data used are 177 companies in ASEAN from 2014 until 2018, selected by

using below purposive sampling method criteria:

a. Companies that are listed in the stock exchange or its benchmark index in ASEAN during period observation 2014

until 2018 which consist of Indonesia (IDX), Singapore (STI), Malaysia (KLCI), Philippines (PSEI) and Thailand (SETI).

STI, KLCI and PSEI are the capitalisation-weighted stock market index that is regarded as the benchmark index for

the country stock exchange that tracks the top 30 companies listed on the exchanges.

b. Excluding the financial sector, Companies that are within the 10 (ten) industries according to the Bloomberg classi-

fication are Communication Services, Consumer Discretionary, Consumer Staples, Energy, Health Care, Industrials,

Information Technology, Materials, Real Estate, and Utilities;

c. Companies that have complete ESG Disclosure Score data from Bloomberg during the observation period from

2014 to 2018.

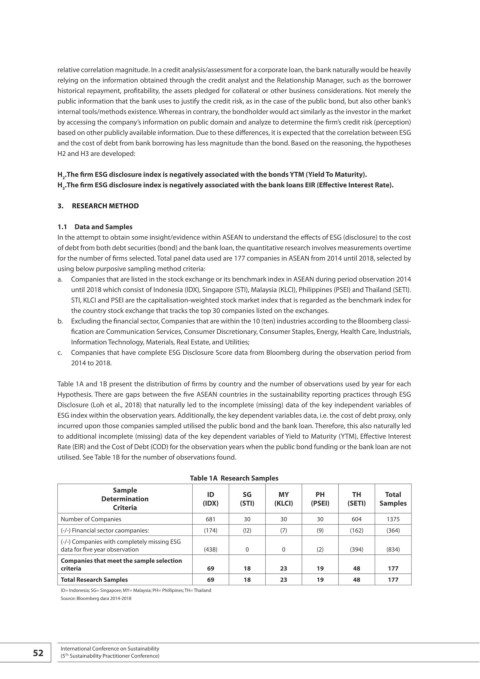

Table 1A and 1B present the distribution of firms by country and the number of observations used by year for each

Hypothesis. There are gaps between the five ASEAN countries in the sustainability reporting practices through ESG

Disclosure (Loh et al., 2018) that naturally led to the incomplete (missing) data of the key independent variables of

ESG index within the observation years. Additionally, the key dependent variables data, i.e. the cost of debt proxy, only

incurred upon those companies sampled utilised the public bond and the bank loan. Therefore, this also naturally led

to additional incomplete (missing) data of the key dependent variables of Yield to Maturity (YTM), Effective Interest

Rate (EIR) and the Cost of Debt (COD) for the observation years when the public bond funding or the bank loan are not

utilised. See Table 1B for the number of observations found.

Table 1A Research Samples

Sample ID SG MY PH TH Total

Determination (IDX) (STI) (KLCI) (PSEI) (SETI) Samples

Criteria

Number of Companies 681 30 30 30 604 1375

(-/-) Financial sector caompanies: (174) (!2) (7) (9) (162) (364)

(-/-) Companies with completely missing ESG

data for five year observation (438) 0 0 (2) (394) (834)

Companies that meet the sample selection

criteria 69 18 23 19 48 177

Total Research Samples 69 18 23 19 48 177

ID= Indonesia; SG= Singapore; MY= Malaysia; PH= Phillipines; TH= Thailand

Source: Bloomberg dara 2014-2018

52 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th