Page 54 - SUSTAINABILITY ISSUES & COVID-19

P. 54

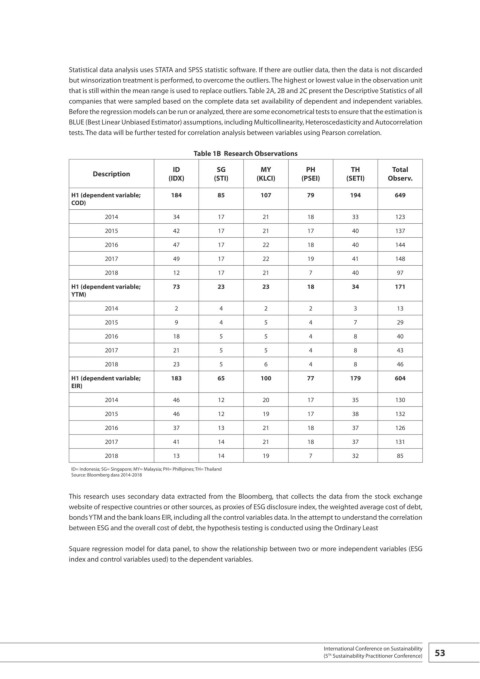

Statistical data analysis uses STATA and SPSS statistic software. If there are outlier data, then the data is not discarded

but winsorization treatment is performed, to overcome the outliers. The highest or lowest value in the observation unit

that is still within the mean range is used to replace outliers. Table 2A, 2B and 2C present the Descriptive Statistics of all

companies that were sampled based on the complete data set availability of dependent and independent variables.

Before the regression models can be run or analyzed, there are some econometrical tests to ensure that the estimation is

BLUE (Best Linear Unbiased Estimator) assumptions, including Multicollinearity, Heteroscedasticity and Autocorrelation

tests. The data will be further tested for correlation analysis between variables using Pearson correlation.

Table 1B Research Observations

ID SG MY PH TH Total

Description

(IDX) (STI) (KLCI) (PSEI) (SETI) Observ.

H1 (dependent variable; 184 85 107 79 194 649

COD)

2014 34 17 21 18 33 123

2015 42 17 21 17 40 137

2016 47 17 22 18 40 144

2017 49 17 22 19 41 148

2018 12 17 21 7 40 97

H1 (dependent variable; 73 23 23 18 34 171

YTM)

2014 2 4 2 2 3 13

2015 9 4 5 4 7 29

2016 18 5 5 4 8 40

2017 21 5 5 4 8 43

2018 23 5 6 4 8 46

H1 (dependent variable; 183 65 100 77 179 604

EIR)

2014 46 12 20 17 35 130

2015 46 12 19 17 38 132

2016 37 13 21 18 37 126

2017 41 14 21 18 37 131

2018 13 14 19 7 32 85

ID= Indonesia; SG= Singapore; MY= Malaysia; PH= Phillipines; TH= Thailand

Source: Bloomberg dara 2014-2018

This research uses secondary data extracted from the Bloomberg, that collects the data from the stock exchange

website of respective countries or other sources, as proxies of ESG disclosure index, the weighted average cost of debt,

bonds YTM and the bank loans EIR, including all the control variables data. In the attempt to understand the correlation

between ESG and the overall cost of debt, the hypothesis testing is conducted using the Ordinary Least

Square regression model for data panel, to show the relationship between two or more independent variables (ESG

index and control variables used) to the dependent variables.

International Conference on Sustainability 53

(5 Sustainability Practitioner Conference)

Th