Page 36 - SUSTAINABILITY ISSUES & COVID-19

P. 36

04 Problems in the Revaluation of Assets

in Indonesia Central Government

Arif Khusni Effendy, Dwi Setiawan

Abstract: This study aims to explore and finds out the main problems that occurred during the implementation of

state-owned assets revaluation by Indonesia Central Government. This research benefit is to increase knowledge

in government accounting in the field of asset management, especially related to asset revaluation. It can also be a

reference if the local government will carry out the local-owned assets revaluation. This study used a qualitative case

study method to explore the phenomena that exist in a case so that it can capture all the complexity and uniqueness

of the case. The result of interviews with the interviewees was analyzed to find the description of the main problems

in implementing the state-owned asset revaluation. The interviewee is an official at the Ministry of Finance in charge of

policy and implementation of the state-owned assets revaluation. Related documents such as Indonesia Government

Financial Reports and Audit Reports from Audit Board of The Republic of Indonesia were also analyzed. The results

of the interview and documents were analyzed using content and thematic analysis. The results showed that there

are two main problems in the implementation of the state-owned asset revaluation. First, Problem in Inventory. The

state-owned asset inventory did not implement optimally. It causes problems in the state-owned asset revaluation and

contributes findings in the Audit Board’s Audit Report related to the state-owned assets revaluation results. Second,

the lack of practical guidelines for revaluation in Indonesia’s Government Accounting Standard (GAS). The state-owned

assets revaluation is following Indonesia’s GAS because it does not regulate much about revaluation. The lack of

practical guidelines for revaluation in GAS is a major problem in implementing state-owned assets revaluations.

Keywords: State-owned assets, revaluation, accounting standard.

1. INTRODUCTION

The Indonesian government as a reporting entity has undergone several changes in the basis of accounting since the

enactment of Government Regulation Number 71 of 2010. The government used Cash-Based Accounting in 2010-2012

so that state-owned assets was still presented based on the acquisition value without any depreciation. The Indonesian

government began to apply the Cash Toward Accrual Basis of Accounting in 2013-2014 so that state-owned assets were

presented based on book value (depreciated value). Accrual-based accounting implemented in 2015, state-owned

assets were presented on book value (Puspitarini, 2017). The Government of Indonesia implemented a revaluation of

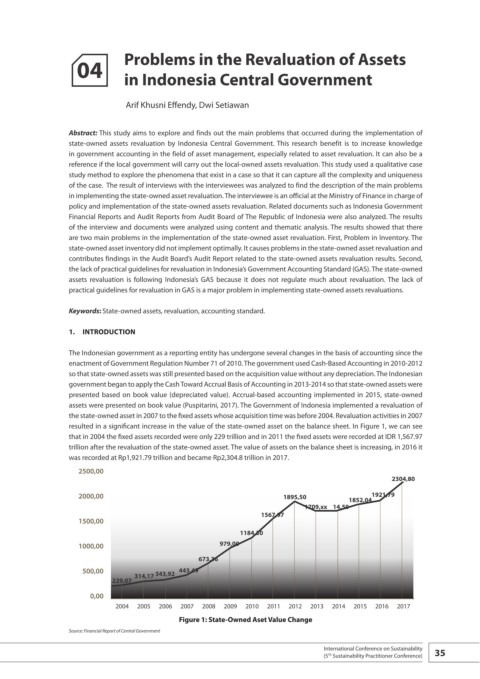

the state-owned asset in 2007 to the fixed assets whose acquisition time was before 2004. Revaluation activities in 2007

resulted in a significant increase in the value of the state-owned asset on the balance sheet. In Figure 1, we can see

that in 2004 the fixed assets recorded were only 229 trillion and in 2011 the fixed assets were recorded at IDR 1,567.97

trillion after the revaluation of the state-owned asset. The value of assets on the balance sheet is increasing, in 2016 it

was recorded at Rp1,921.79 trillion and became Rp2,304.8 trillion in 2017.

2500,00

2304,80

2000,00 1895,50 1852,04 1921,79

1709,xx 14,50

1567,97

1500,00

1184,30

1000,00 979,00

673,36

500,00 314,17 343,92 443,49

229,07

0,00

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Figure 1: State-Owned Aset Value Change

Source: Financial Report of Central Government

International Conference on Sustainability 35

(5 Sustainability Practitioner Conference)

Th