Page 32 - SUSTAINABILITY ISSUES & COVID-19

P. 32

Based on the two tables above, it can be explained that:

1. PT PG Rajawali II has the highest total assets but is not comparable to the lowest Asset Turnover Ratio (ATO) (0.2x)

than other subsidiaries.

2. From the capital structure, it can be seen that the paid-up capital for PT PG Rajawali II is the highest but it is not

comparable to the retained earnings balance which shows a negative amount of IDR 498 billion.

3. In terms of assets and sales, PT PG Candi Baru has the smallest total compared to PT PG Rajawali I and PT PG

Rajawali II. This is because the size of the company is much smaller than the others and the location / presence of

PT PG Candi Baru is in a residential area, making it difficult for the company to expand.

From the above explanation, PT PG Rajawali I became the leader in the merger and later PT PG Rajawali II and PT PG

Candi Baru would be under the management of PT PG Rajawali I.

Looking at the Company’s Corporate Goals, wherein 2020-2021 there will be restructuring, one of which is the merger

of PT PG Rajawali I and PT PG Rajawali II for efficiency purposes. As stated in Attachment SE-23 PJ 42 Year 1999 regarding

the example of the last tax year for a business entity that transfers assets (transferor company) where:

“PT A and PT B each use a calendar year as their tax year. December 31, 1999, PT B effectively merged into PT A. The last tax

year for PT B was the entire tax year (1999) ended December 31, 1999. PT A and PT B were still reporting their respective SPT

PPh for the 1999 tax year.“.

In this case, it means that each subsidiary still has to show financial reports accordingly to the parent company because

the new business merger will be realized in 2021. Legally, PT PG Rajawali I have not conducted a business merger

(merger) and these three subsidiaries are already entrepreneurs. Subject to Tax (PKP), it is obligatory to report each

financial report and SPT PPh to the Directorate General of Taxes (DGT).

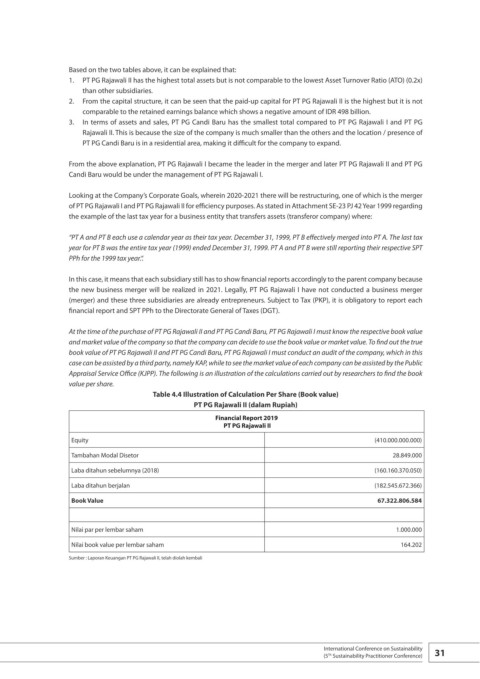

At the time of the purchase of PT PG Rajawali II and PT PG Candi Baru, PT PG Rajawali I must know the respective book value

and market value of the company so that the company can decide to use the book value or market value. To find out the true

book value of PT PG Rajawali II and PT PG Candi Baru, PT PG Rajawali I must conduct an audit of the company, which in this

case can be assisted by a third party, namely KAP, while to see the market value of each company can be assisted by the Public

Appraisal Service Office (KJPP). The following is an illustration of the calculations carried out by researchers to find the book

value per share.

Table 4.4 Illustration of Calculation Per Share (Book value)

PT PG Rajawali II (dalam Rupiah)

Financial Report 2019

PT PG Rajawali II

Equity (410.000.000.000)

Tambahan Modal Disetor 28.849.000

Laba ditahun sebelumnya (2018) (160.160.370.050)

Laba ditahun berjalan (182.545.672.366)

Book Value 67.322.806.584

Nilai par per lembar saham 1.000.000

Nilai book value per lembar saham 164.202

Sumber : Laporan Keuangan PT PG Rajawali II, telah diolah kembali

International Conference on Sustainability 31

(5 Sustainability Practitioner Conference)

Th