Page 33 - SUSTAINABILITY ISSUES & COVID-19

P. 33

Based on calculations made by researchers, PT PG Rajawali I can acquire PT PG Rajawali II using book value. It can

be seen that PT PG Rajawali II suffered losses so that the book value per share was below par. The reasons for this

acquisition include:

1. PT PG Rajawali II is the sister company of PT PG Rajawali I, and PT PG Rajawali II. In recent years, PT PG Rajawali II has

suffered losses, however, seen from the financial statements on the financial burden side, it can still be improved

by updating the management system and asking for assistance from third parties such as consultants to be able to

improve and restructure the composition of the management (if in PT PG Rajawali II there is fraud caused by SDM).

2. On the sales side, PT PG Rajawali II is still classified as stable, namely Rp. 505,618,921,141 which has increased from

the previous year which was Rp. 405,984,304,664.

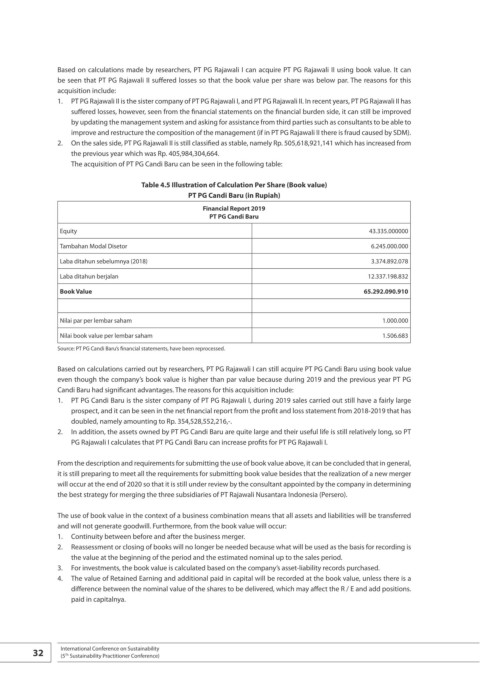

The acquisition of PT PG Candi Baru can be seen in the following table:

Table 4.5 Illustration of Calculation Per Share (Book value)

PT PG Candi Baru (in Rupiah)

Financial Report 2019

PT PG Candi Baru

Equity 43.335.000000

Tambahan Modal Disetor 6.245.000.000

Laba ditahun sebelumnya (2018) 3.374.892.078

Laba ditahun berjalan 12.337.198.832

Book Value 65.292.090.910

Nilai par per lembar saham 1.000.000

Nilai book value per lembar saham 1.506.683

Source: PT PG Candi Baru’s financial statements, have been reprocessed.

Based on calculations carried out by researchers, PT PG Rajawali I can still acquire PT PG Candi Baru using book value

even though the company’s book value is higher than par value because during 2019 and the previous year PT PG

Candi Baru had significant advantages. The reasons for this acquisition include:

1. PT PG Candi Baru is the sister company of PT PG Rajawali I, during 2019 sales carried out still have a fairly large

prospect, and it can be seen in the net financial report from the profit and loss statement from 2018-2019 that has

doubled, namely amounting to Rp. 354,528,552,216,-.

2. In addition, the assets owned by PT PG Candi Baru are quite large and their useful life is still relatively long, so PT

PG Rajawali I calculates that PT PG Candi Baru can increase profits for PT PG Rajawali I.

From the description and requirements for submitting the use of book value above, it can be concluded that in general,

it is still preparing to meet all the requirements for submitting book value besides that the realization of a new merger

will occur at the end of 2020 so that it is still under review by the consultant appointed by the company in determining

the best strategy for merging the three subsidiaries of PT Rajawali Nusantara Indonesia (Persero).

The use of book value in the context of a business combination means that all assets and liabilities will be transferred

and will not generate goodwill. Furthermore, from the book value will occur:

1. Continuity between before and after the business merger.

2. Reassessment or closing of books will no longer be needed because what will be used as the basis for recording is

the value at the beginning of the period and the estimated nominal up to the sales period.

3. For investments, the book value is calculated based on the company’s asset-liability records purchased.

4. The value of Retained Earning and additional paid in capital will be recorded at the book value, unless there is a

difference between the nominal value of the shares to be delivered, which may affect the R / E and add positions.

paid in capitalnya.

32 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th