Page 194 - SUSTAINABILITY ISSUES & COVID-19

P. 194

Table 3 Descriptive Statistics of SOEs and Non-SOEs

Variables N Min. Max. Mean Std. Devt.

EAR 294 -.2820 .9635 .427061 .2400

DAR 294 .0271 .9820 .566993 .2387

ROA 294 -.5500 .9251 .051128 .1051

ROE 294 -1.230 .6659 .128857 .4559

SUST_R 294 0 1 .49 .500

Only 49% of companies specifically make sustainability reports, the rest don’t. Many companies have reported social

responsibility or corporate social responsibility and corporate governance reports and alluded to business continuity,

but 51% did not report in a special report.

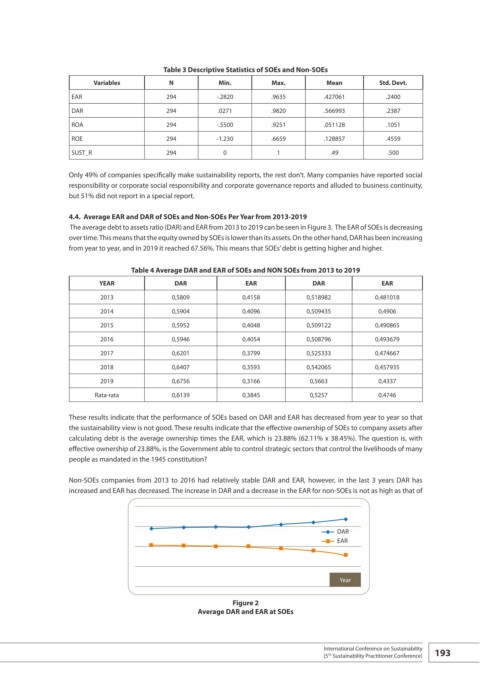

4.4. Average EAR and DAR of SOEs and Non-SOEs Per Year from 2013-2019

The average debt to assets ratio (DAR) and EAR from 2013 to 2019 can be seen in Figure 3. The EAR of SOEs is decreasing

over time. This means that the equity owned by SOEs is lower than its assets. On the other hand, DAR has been increasing

from year to year, and in 2019 it reached 67.56%. This means that SOEs’ debt is getting higher and higher.

Table 4 Average DAR and EAR of SOEs and NON SOEs from 2013 to 2019

YEAR DAR EAR DAR EAR

2013 0,5809 0,4158 0,518982 0,481018

2014 0,5904 0,4096 0,509435 0,4906

2015 0,5952 0,4048 0,509122 0,490865

2016 0,5946 0,4054 0,508796 0,493679

2017 0,6201 0,3799 0,525333 0,474667

2018 0,6407 0,3593 0,542065 0,457935

2019 0,6756 0,3166 0,5663 0,4337

Rata-rata 0,6139 0,3845 0,5257 0,4746

These results indicate that the performance of SOEs based on DAR and EAR has decreased from year to year so that

the sustainability view is not good. These results indicate that the effective ownership of SOEs to company assets after

calculating debt is the average ownership times the EAR, which is 23.88% (62.11% x 38.45%). The question is, with

effective ownership of 23.88%, is the Government able to control strategic sectors that control the livelihoods of many

people as mandated in the 1945 constitution?

Non-SOEs companies from 2013 to 2016 had relatively stable DAR and EAR, however, in the last 3 years DAR has

increased and EAR has decreased. The increase in DAR and a decrease in the EAR for non-SOEs is not as high as that of

DAR

EAR

Year

Figure 2

Average DAR and EAR at SOEs

International Conference on Sustainability 193

(5 Sustainability Practitioner Conference)

Th