Page 15 - SUSTAINABILITY ISSUES & COVID-19

P. 15

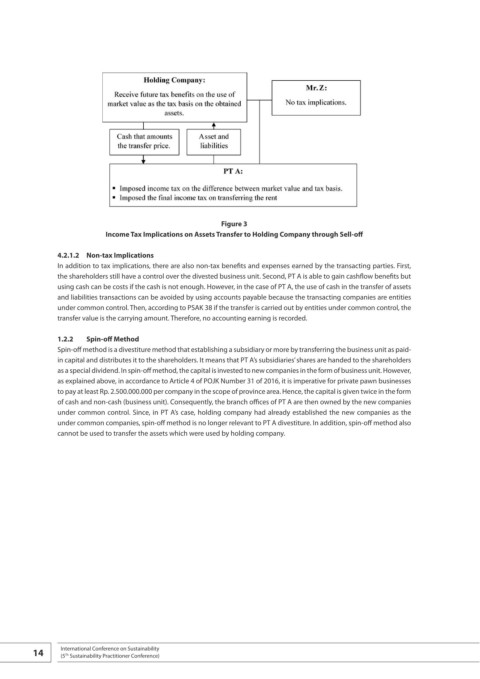

Figure 3

Income Tax Implications on Assets Transfer to Holding Company through Sell-off

4.2.1.2 Non-tax Implications

In addition to tax implications, there are also non-tax benefits and expenses earned by the transacting parties. First,

the shareholders still have a control over the divested business unit. Second, PT A is able to gain cashflow benefits but

using cash can be costs if the cash is not enough. However, in the case of PT A, the use of cash in the transfer of assets

and liabilities transactions can be avoided by using accounts payable because the transacting companies are entities

under common control. Then, according to PSAK 38 if the transfer is carried out by entities under common control, the

transfer value is the carrying amount. Therefore, no accounting earning is recorded.

1.2.2 Spin-off Method

Spin-off method is a divestiture method that establishing a subsidiary or more by transferring the business unit as paid-

in capital and distributes it to the shareholders. It means that PT A’s subsidiaries’ shares are handed to the shareholders

as a special dividend. In spin-off method, the capital is invested to new companies in the form of business unit. However,

as explained above, in accordance to Article 4 of POJK Number 31 of 2016, it is imperative for private pawn businesses

to pay at least Rp. 2.500.000.000 per company in the scope of province area. Hence, the capital is given twice in the form

of cash and non-cash (business unit). Consequently, the branch offices of PT A are then owned by the new companies

under common control. Since, in PT A’s case, holding company had already established the new companies as the

under common companies, spin-off method is no longer relevant to PT A divestiture. In addition, spin-off method also

cannot be used to transfer the assets which were used by holding company.

14 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th