Page 11 - SUSTAINABILITY ISSUES & COVID-19

P. 11

4. RESULT AND ANALYSIS

PT A is a licensed gold trading company that has been operating since 2014. The company further developed its

business into a gold pawn company with no official pawn business license, and had grown in 6 provinces in Indonesia.

Therefore, the main objective of PT A’s divestiture is to maintain their business license from the Financial Services

Authority. In order to be licensed, PT A must satisfy one of the requirements constituted in Article 4 paragraph 1 of POJK

Number 31 of 2016, that is to denationalize their business to province area. Failure to comply with this requirement

would merit rejection of license request, and even sanction in the form of suspension, for the business is deemed

illegal. In response to this requirement, PT A chose to divest their business for legal reasons, which is categorized as an

involuntary divestiture due to its motives to merely comply with POJK Number 31 of 2016 and to avoid sanction.

Figure 1

Structures of PT A and the New Companies

Source: PT A

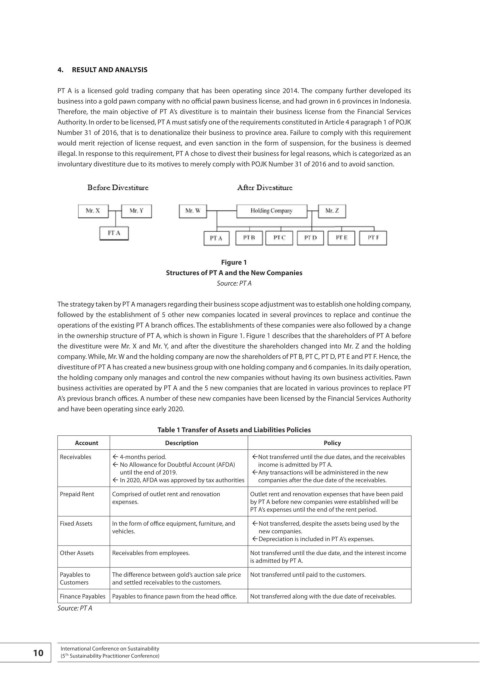

The strategy taken by PT A managers regarding their business scope adjustment was to establish one holding company,

followed by the establishment of 5 other new companies located in several provinces to replace and continue the

operations of the existing PT A branch offices. The establishments of these companies were also followed by a change

in the ownership structure of PT A, which is shown in Figure 1. Figure 1 describes that the shareholders of PT A before

the divestiture were Mr. X and Mr. Y, and after the divestiture the shareholders changed into Mr. Z and the holding

company. While, Mr. W and the holding company are now the shareholders of PT B, PT C, PT D, PT E and PT F. Hence, the

divestiture of PT A has created a new business group with one holding company and 6 companies. In its daily operation,

the holding company only manages and control the new companies without having its own business activities. Pawn

business activities are operated by PT A and the 5 new companies that are located in various provinces to replace PT

A’s previous branch offices. A number of these new companies have been licensed by the Financial Services Authority

and have been operating since early 2020.

Table 1 Transfer of Assets and Liabilities Policies

Account Description Policy

Receivables ß 4-months period. ß Not transferred until the due dates, and the receivables

ß No Allowance for Doubtful Account (AFDA) income is admitted by PT A.

until the end of 2019. ß ny transactions will be administered in the new

A

I

ß n 2020, AFDA was approved by tax authorities companies after the due date of the receivables.

Prepaid Rent Comprised of outlet rent and renovation Outlet rent and renovation expenses that have been paid

expenses. by PT A before new companies were established will be

PT A’s expenses until the end of the rent period.

Fixed Assets In the form of office equipment, furniture, and ß Not transferred, despite the assets being used by the

vehicles. new companies.

ß epreciation is included in PT A’s expenses.

D

Other Assets Receivables from employees. Not transferred until the due date, and the interest income

is admitted by PT A.

Payables to The difference between gold’s auction sale price Not transferred until paid to the customers.

Customers and settled receivables to the customers.

Finance Payables Payables to finance pawn from the head office. Not transferred along with the due date of receivables.

Source: PT A

10 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th