Page 12 - SUSTAINABILITY ISSUES & COVID-19

P. 12

However, in the process of divesting the business, PT A implemented a policy to not transfer their assets and liabilities

to the new companies in order to avoid tax expenses that might be incurred. The policies on the assets and liabilities

management in branch and main offices of PT A are as shown in Table 1. Table 1 shows that none of PT A’s recorded

assets was transferred to the new companies, even though the assets are used and controlled by the them to continue

the operations. Asset in the form of receivables were also not transferred and remained written under PT A’s accounting

record until the due dates. If a customer wishes to do another pawn transaction after the due date, it will then be

recorded in the accounting book of the new company that operates in that particular area. Prepaid outlet rent remained

written under PT A’s accounting book even though several outlets are used by the new companies. The same also

applies to the fixed assets and liabilities.

In terms of taxation, by the end of 2019, PT A did not record any compensable loss, and they recorded retained earnings,

hence the levied corporate income tax (Article 25 Income Tax) in 2020. In addition, PT A along with its new companies

are not taxable enterprises, meaning no Value Added Tax (VAT) credit to be claimed and imposed.

4.1 Company Divestiture’s Tax Implications

The strategy undertaken by PT A in order to comply with the scope of the business area is establishing a holding

company that established new companies without transferring assets and liabilities of PT A to these new companies. By

not transferring assets and liabilities, operationally nothing happens because all PT A’s branch offices are still under the

control of PT A, which causes all revenues and expenses to remain recorded at PT A. Therefore, PT A’s operating income

and expenses looks greater than it should be. Then, for new companies, the revenue will appear lower than it should

be. Although some of new companies’ operational expenses are recorded by PT A, each new company have to record

board of directors’ salary thus it can be expected that new companies will experience large operational expenses or

even cause losses for the current year.

Although for the majority shareholder, who records the profit and loss is not a significant issue. However, if the PT

branch offices’ assets and liabilities are transferred to new companies, expectedly the new companies will generate

profit or reduce loss for the current year. If high profit or minimal loss was generated by new companies, it would

increase the confidence of any unaffiliated parties to provide financing loan to new companies rather than if there is

no transfer of assets and liabilities. This external financing can be used for business expansion so the shareholders and

affiliate parties does not have to provide financing.

The divestiture of PT A has made their branch offices in the provinces change into independent companies, which

means that every new company has their own tax liabilities albeit their status in the business group. Nevertheless, PT A

did not transfer the assets of their branch offices to the new companies and to parent company to minimize or avoid tax

expenses during and after the process. In this context, taxes that are related to asset transfer are Value Added Tax (VAT)

and Income Tax. VAT could not be levied on PT A and its new companies because they were not taxable enterprises.

Ergo, the divestiture of PT A has implications on the income tax. The income tax implications on transfer of assets in PT

A reviewed from the group’s interest is shown in Table 2.

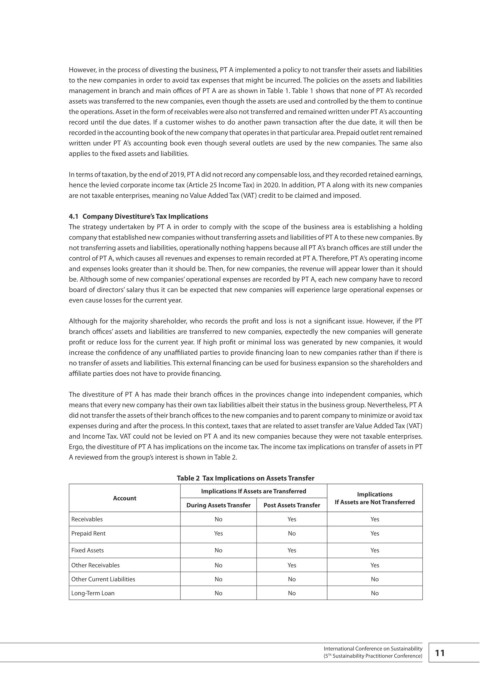

Table 2 Tax Implications on Assets Transfer

Implications If Assets are Transferred Implications

Account If Assets are Not Transferred

During Assets Transfer Post Assets Transfer

Receivables No Yes Yes

Prepaid Rent Yes No Yes

Fixed Assets No Yes Yes

Other Receivables No Yes Yes

Other Current Liabilities No No No

Long-Term Loan No No No

International Conference on Sustainability 11

(5 Sustainability Practitioner Conference)

Th