Page 17 - SUSTAINABILITY ISSUES & COVID-19

P. 17

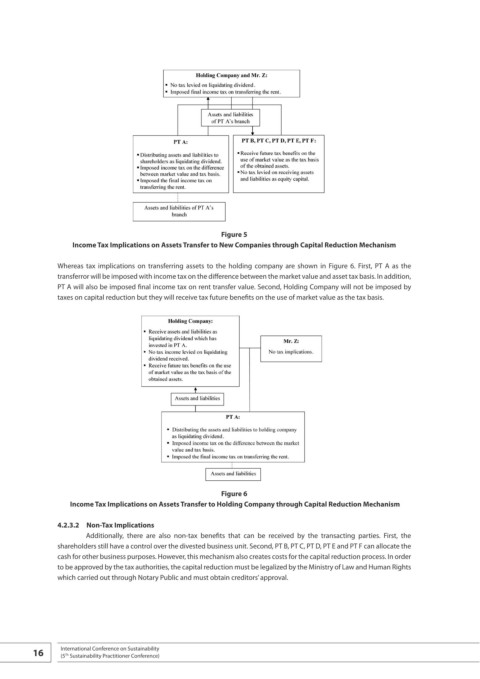

Figure 5

Income Tax Implications on Assets Transfer to New Companies through Capital Reduction Mechanism

Whereas tax implications on transferring assets to the holding company are shown in Figure 6. First, PT A as the

transferror will be imposed with income tax on the difference between the market value and asset tax basis. In addition,

PT A will also be imposed final income tax on rent transfer value. Second, Holding Company will not be imposed by

taxes on capital reduction but they will receive tax future benefits on the use of market value as the tax basis.

Figure 6

Income Tax Implications on Assets Transfer to Holding Company through Capital Reduction Mechanism

4.2.3.2 Non-Tax Implications

Additionally, there are also non-tax benefits that can be received by the transacting parties. First, the

shareholders still have a control over the divested business unit. Second, PT B, PT C, PT D, PT E and PT F can allocate the

cash for other business purposes. However, this mechanism also creates costs for the capital reduction process. In order

to be approved by the tax authorities, the capital reduction must be legalized by the Ministry of Law and Human Rights

which carried out through Notary Public and must obtain creditors’ approval.

16 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th