Page 42 - SUSTAINABILITY ISSUES & COVID-19

P. 42

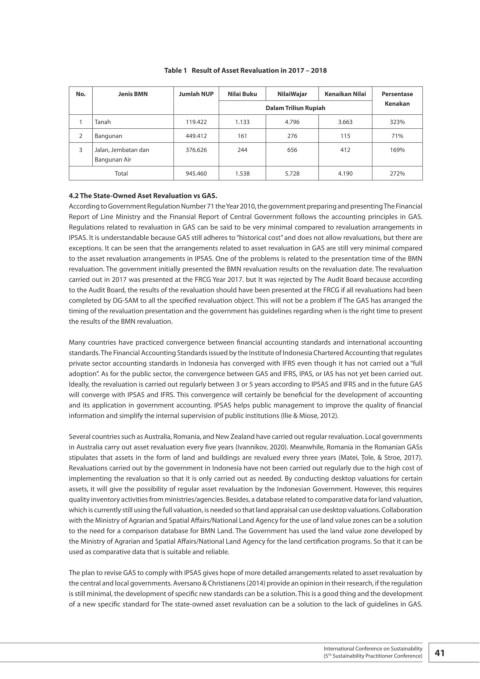

Table 1 Result of Asset Revaluation in 2017 – 2018

No. Jenis BMN Jumlah NUP Nilai Buku NilaiWajar Kenaikan Nilai Persentase

Kenakan

Dalam Triliun Rupiah

1 Tanah 119.422 1.133 4.796 3.663 323%

2 Bangunan 449.412 161 276 115 71%

3 Jalan, Jembatan dan 376.626 244 656 412 169%

Bangunan Air

Total 945.460 1.538 5.728 4.190 272%

4.2 The State-Owned Aset Revaluation vs GAS.

According to Government Regulation Number 71 the Year 2010, the government preparing and presenting The Financial

Report of Line Ministry and the Finansial Report of Central Government follows the accounting principles in GAS.

Regulations related to revaluation in GAS can be said to be very minimal compared to revaluation arrangements in

IPSAS. It is understandable because GAS still adheres to “historical cost” and does not allow revaluations, but there are

exceptions. It can be seen that the arrangements related to asset revaluation in GAS are still very minimal compared

to the asset revaluation arrangements in IPSAS. One of the problems is related to the presentation time of the BMN

revaluation. The government initially presented the BMN revaluation results on the revaluation date. The revaluation

carried out in 2017 was presented at the FRCG Year 2017. but It was rejected by The Audit Board because according

to the Audit Board, the results of the revaluation should have been presented at the FRCG if all revaluations had been

completed by DG-SAM to all the specified revaluation object. This will not be a problem if The GAS has arranged the

timing of the revaluation presentation and the government has guidelines regarding when is the right time to present

the results of the BMN revaluation.

Many countries have practiced convergence between financial accounting standards and international accounting

standards. The Financial Accounting Standards issued by the Institute of Indonesia Chartered Accounting that regulates

private sector accounting standards in Indonesia has converged with IFRS even though it has not carried out a “full

adoption”. As for the public sector, the convergence between GAS and IFRS, IPAS, or IAS has not yet been carried out.

Ideally, the revaluation is carried out regularly between 3 or 5 years according to IPSAS and IFRS and in the future GAS

will converge with IPSAS and IFRS. This convergence will certainly be beneficial for the development of accounting

and its application in government accounting. IPSAS helps public management to improve the quality of financial

information and simplify the internal supervision of public institutions (Ilie & Miose, 2012).

Several countries such as Australia, Romania, and New Zealand have carried out regular revaluation. Local governments

in Australia carry out asset revaluation every five years (Ivannikov, 2020). Meanwhile, Romania in the Romanian GASs

stipulates that assets in the form of land and buildings are revalued every three years (Matei, Ţole, & Stroe, 2017).

Revaluations carried out by the government in Indonesia have not been carried out regularly due to the high cost of

implementing the revaluation so that it is only carried out as needed. By conducting desktop valuations for certain

assets, it will give the possibility of regular asset revaluation by the Indonesian Government. However, this requires

quality inventory activities from ministries/agencies. Besides, a database related to comparative data for land valuation,

which is currently still using the full valuation, is needed so that land appraisal can use desktop valuations. Collaboration

with the Ministry of Agrarian and Spatial Affairs/National Land Agency for the use of land value zones can be a solution

to the need for a comparison database for BMN Land. The Government has used the land value zone developed by

the Ministry of Agrarian and Spatial Affairs/National Land Agency for the land certification programs. So that it can be

used as comparative data that is suitable and reliable.

The plan to revise GAS to comply with IPSAS gives hope of more detailed arrangements related to asset revaluation by

the central and local governments. Aversano & Christianens (2014) provide an opinion in their research, if the regulation

is still minimal, the development of specific new standards can be a solution. This is a good thing and the development

of a new specific standard for The state-owned asset revaluation can be a solution to the lack of guidelines in GAS.

International Conference on Sustainability 41

(5 Sustainability Practitioner Conference)

Th