Page 24 - SUSTAINABILITY ISSUES & COVID-19

P. 24

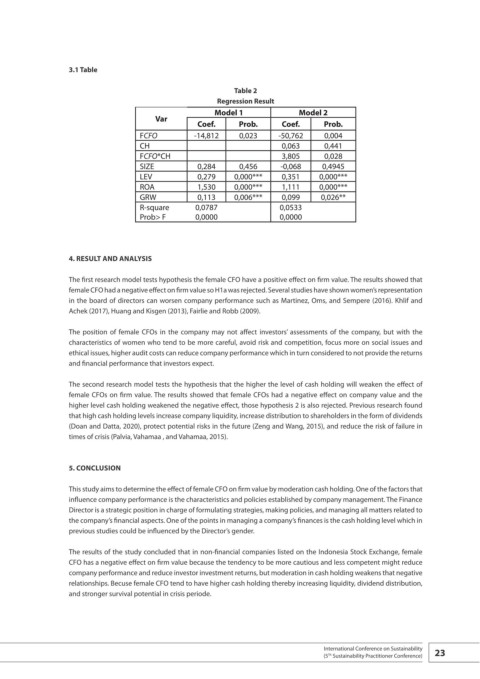

3.1 Table

Table 2

Regression Result

Model 1 Model 2

Var

Coef. Prob. Coef. Prob.

FCFO -14,812 0,023 -50,762 0,004

CH 0,063 0,441

FCFO*CH 3,805 0,028

SIZE 0,284 0,456 -0,068 0,4945

LEV 0,279 0,000*** 0,351 0,000***

ROA 1,530 0,000*** 1,111 0,000***

GRW 0,113 0,006*** 0,099 0,026**

R-square 0,0787 0,0533

Prob> F 0,0000 0,0000

4. RESULT AND ANALYSIS

The first research model tests hypothesis the female CFO have a positive effect on firm value. The results showed that

female CFO had a negative effect on firm value so H1a was rejected. Several studies have shown women’s representation

in the board of directors can worsen company performance such as Martinez, Oms, and Sempere (2016). Khlif and

Achek (2017), Huang and Kisgen (2013), Fairlie and Robb (2009).

The position of female CFOs in the company may not affect investors’ assessments of the company, but with the

characteristics of women who tend to be more careful, avoid risk and competition, focus more on social issues and

ethical issues, higher audit costs can reduce company performance which in turn considered to not provide the returns

and financial performance that investors expect.

The second research model tests the hypothesis that the higher the level of cash holding will weaken the effect of

female CFOs on firm value. The results showed that female CFOs had a negative effect on company value and the

higher level cash holding weakened the negative effect, those hypothesis 2 is also rejected. Previous research found

that high cash holding levels increase company liquidity, increase distribution to shareholders in the form of dividends

(Doan and Datta, 2020), protect potential risks in the future (Zeng and Wang, 2015), and reduce the risk of failure in

times of crisis (Palvia, Vahamaa , and Vahamaa, 2015).

5. CONCLUSION

This study aims to determine the effect of female CFO on firm value by moderation cash holding. One of the factors that

influence company performance is the characteristics and policies established by company management. The Finance

Director is a strategic position in charge of formulating strategies, making policies, and managing all matters related to

the company’s financial aspects. One of the points in managing a company’s finances is the cash holding level which in

previous studies could be influenced by the Director’s gender.

The results of the study concluded that in non-financial companies listed on the Indonesia Stock Exchange, female

CFO has a negative effect on firm value because the tendency to be more cautious and less competent might reduce

company performance and reduce investor investment returns, but moderation in cash holding weakens that negative

relationships. Becuse female CFO tend to have higher cash holding thereby increasing liquidity, dividend distribution,

and stronger survival potential in crisis periode.

International Conference on Sustainability 23

(5 Sustainability Practitioner Conference)

Th