Page 23 - SUSTAINABILITY ISSUES & COVID-19

P. 23

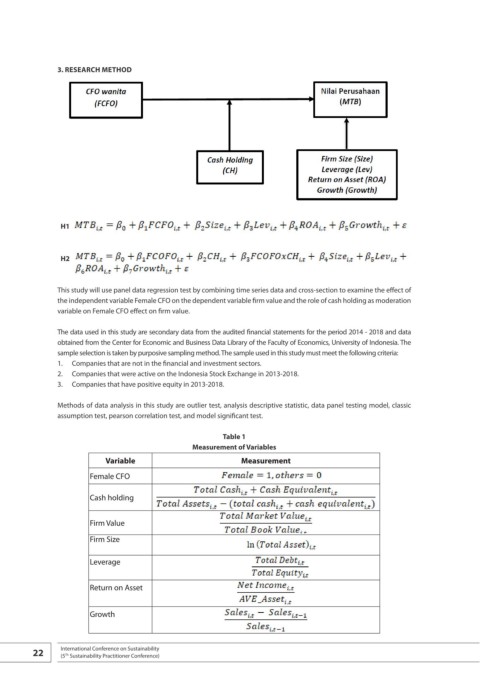

3. RESEARCH METHOD

H1

H2

This study will use panel data regression test by combining time series data and cross-section to examine the effect of

the independent variable Female CFO on the dependent variable firm value and the role of cash holding as moderation

variable on Female CFO effect on firm value.

The data used in this study are secondary data from the audited financial statements for the period 2014 - 2018 and data

obtained from the Center for Economic and Business Data Library of the Faculty of Economics, University of Indonesia. The

sample selection is taken by purposive sampling method. The sample used in this study must meet the following criteria:

1. Companies that are not in the financial and investment sectors.

2. Companies that were active on the Indonesia Stock Exchange in 2013-2018.

3. Companies that have positive equity in 2013-2018.

Methods of data analysis in this study are outlier test, analysis descriptive statistic, data panel testing model, classic

assumption test, pearson correlation test, and model significant test.

Table 1

Measurement of Variables

Variable Measurement

Female CFO

Cash holding

Firm Value

Firm Size

Leverage

Return on Asset

Growth

22 International Conference on Sustainability

(5 Sustainability Practitioner Conference)

Th