Page 182 - SUSTAINABILITY ISSUES & COVID-19

P. 182

Previous research has examined the relationship between bribery and the presence of external auditors (Khalil et al.,

2015). The results show that bribes made to get a contract with the government are lower if the company’s financial

statements are examined by an external auditor. Thus, companies that do not use external auditors may be more

courageous and have the opportunity to commit bribes.

Public distrust of the judiciary exists throughout the country. This has a correlation with the improvement of a country’s

economy. If the judicial system can be unfair, impartial and corrupt, bribery can be considered ethical or reasonable

to do (Ariyanto, 2020). Companies are aware of sanctions for violations such as bribes, but companies investing in

corrupt countries consider existing business competition (Webster & Piesse, 2018). Athanasouli & Goujard (2015) in

their research show that companies that are dependent on government contracts assume that the existing courts are

corrupt and impartial but do not report a slow system.

The size and age of the company influence the level of bribery charges. Large companies and those that have been

established for a long time must have a wider network and have a stronger reputation. Large companies tend to

be targets for corrupt officials (Freund et al., 2016). However, large and existing companies should be able to find

alternatives to prosecuting bribes (Gago-Rodríguez et al., 2020). Research by Khalil et al. (2015) referring to Kaufmann

and Wei (1999) and Daboub et al. (1995) stated that small companies are more likely to pay bribes. To show good

performance, large companies tend to choose to pay large taxes because the greater the profit, the greater the tax

burden. Company size can be measured by Ln total assets, sales or number of permanent employees as company size

(Khalil et al., 2015; Qi & Ongena, 2019; Xia et al., 2018).

The presence of competitors discourages companies from committing bribes (Gago-Rodríguez et al., 2020). It is more

expensive to pay if the company bribes. Companies that do not engage in bribery can send positive signals to the

market so that the value of the company increases.

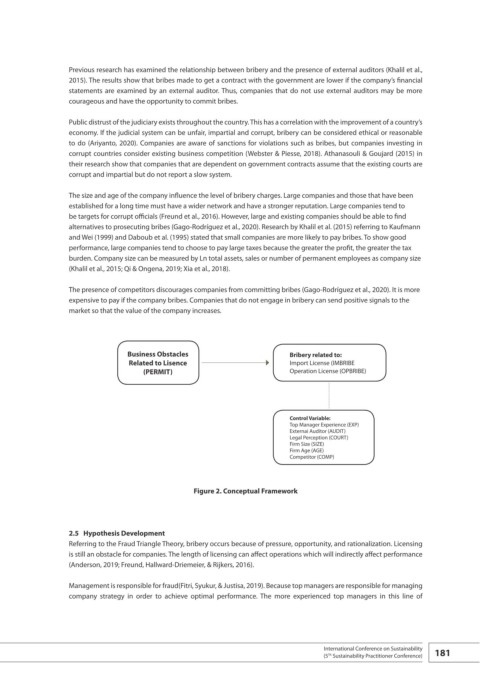

Business Obstacles Bribery related to:

Related to Lisence Import License (IMBRIBE

(PERMIT) Operation License (OPBRIBE)

Control Variable:

Top Manager Experience (EXP)

Externai Auditor (AUDIT)

Legal Perception (COURT)

Firm Size (SIZE)

Firm Age (AGE)

Competitor (COMP)

Figure 2. Conceptual Framework

2.5 Hypothesis Development

Referring to the Fraud Triangle Theory, bribery occurs because of pressure, opportunity, and rationalization. Licensing

is still an obstacle for companies. The length of licensing can affect operations which will indirectly affect performance

(Anderson, 2019; Freund, Hallward-Driemeier, & Rijkers, 2016).

Management is responsible for fraud(Fitri, Syukur, & Justisa, 2019). Because top managers are responsible for managing

company strategy in order to achieve optimal performance. The more experienced top managers in this line of

International Conference on Sustainability 181

(5 Sustainability Practitioner Conference)

Th